Our Mission

|

Collaborate

I feel an obligation to work with trusted advisors to help them to do the best job possible for their clients. Sometimes this includes considering a reverse mortgage as a source of liquidity for the estate or retirement planning. My role is to be a trusted advisor for the advisor, for their clients and their families. |

Problem-Solve

I view trusted advisors as “financial physicians''. Their profession is to assess the difference between what a client has and what he wants or needs. They use questions to assess if a client has a “fever”. Once the medicine is administered, their client can sing, Hey, 98.6, it’s good to have you back again! |

I encourage you to call me to discuss your or your clients case without any concerns. As Bar Association, PFAC, Chamber of Commerce, AFCPE, NRMLA and FPA members, we adhere to a rigorous ethical standard.

Read More About Reverse Your Thinking® Mortgage's Mission

Read More About Reverse Your Thinking® Mortgage's Mission

What is a Reverse Mortgage or a HECM?

Call Us: 310-447-5266 |

The most common type of reverse mortgage is a loan insured by the Federal Housing Administration (FHA), which is also called a HECM. It allows you to access your home equity and turn it into cash. Borrowers choose a reverse mortgage because it allows them to remain in their homes, as long as they meet the loan terms, and provides funds that can greatly supplement their retirement income.

Eliminate the burden of a monthly mortgage payment, you can free up cash to cover other important expenses.* The proceeds are tax-free** and can be used in various ways, like paying health care costs or financing home renovations and afford to stay in the home you love and age in place.* |

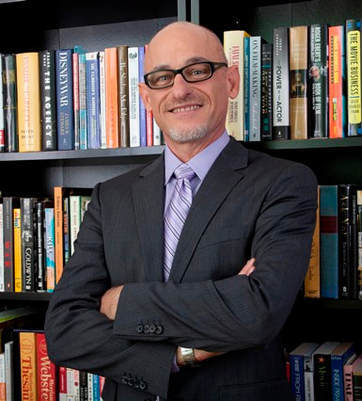

The Reverse Mortgage Specialist

Mathius M. Gertz |

Reverse Your Thinking® MortgageMathius M. Gertz (Marc) is a Mortgage Broker with Reverse Your Thinking® Mortgage and is located in Los Angeles County. Marc holds a Masters in Business Administration (MBA), is an Accredited Financial Counselor (AFC®), a Certified Aging in Place Specialist (CAPS), and also a Certified Divorce Lending Professional (CDLP). Through his mortgage practice, Marc represents a complete spectrum of reverse mortgage and limited equity share programs. He collaborates with trusted advisors to design and implement programs that satisfy the legal and financial planning needs of their clients. As an AFC®, he offers both lender-sponsored programs to his clients as well as fee-based counseling.

Marc maintains a holistic collaborative approach to the reverse financial planning process that includes educating advisors and keeping them current on financial strategies to help protect the quality of their clients lives. Marc believes that the key to a successful long term retirement plan is open communication and being proactive, along with a plan designed to address the unique needs and goals of each and every client. The three watch-words of his practice are; collaborate, educate, problem-solve. An expert and specialist in reverse financial retirement plans and their history, Marc is frequently invited to present training and educational sessions for attorneys, financial planners, fiduciaries, accountants and bankers. He also does educational seminars for schools, colleges, and community & fraternal groups on wealth creation, money and emotions, aging in place and political and financial literacy. Marc has earned a reputation for explaining difficult subjects in a style that is easily understood. |

Reverse Mortgages - Why All The Negative Press?

Since the 1930s, when President Roosevelt was in office, Congress has passed a never-ending series of social legislation. These laws benefited the middle and lower economic classes. The one piece of legislation passed back then that most people remember was the Social Security Act of 1935. At that time, they promised that social security would “solve senior poverty.”

By 1955, Congress knew that Social Security was in financial trouble to accomplish that goal. So working with the IRS, they passed laws to help induce Americans to save for retirement and supplement what little they would get from Social Security. That is where IRA, Keogh, SEP, and 401k plans come from, which have a favorable impression in most Americans' minds.

Home Equity Conversion Mortgage (HECM) programs were another part of that ongoing federal social legislation. But the HECM program suffers from a mixed reputation. Why?

Some mortgage companies in the 1960s came up with an idea for a new type of loan they called a reverse mortgage.

Under their plan, you signed over the title to your home to the lender. The lender would allow you to live in your home for the rest of your life. While they would make your mortgage payments for you and pay you an income per month for your life. Then, when you and your spouse passed away, the lender owned the house. This program was a good solution for some people with not enough income to live on; however, there was a problem.

Starting in the mid-1970s, these reverse mortgage homeowners began to pass away, and that’s when many of their grown children found out for the first time that they weren’t going to inherit the home.

There were several newspaper articles about the turmoil. Mistreatment of seniors, or elder abuse, was the subject of many articles by columnists like Ann Landers. There were several lawsuits, investigations, congressional hearings, and lots of bad press. By the early 1980s, these so-called “reverse loans” had all but vanished.

However, an entire generation, the Baby Boomers and their children, now believed that anything called a reverse mortgage was terrible. But the only thing those programs from the 1960s have in common with the current programs, which didn't become permanent until 1998, is the same nickname, reverse mortgage. Otherwise, they have nothing in common with one another.

It is important to remember that HECM loans are a piece of federal social legislation like IRA, Keogh, and 401k plans that private companies administer. HECMS were signed into law in 1988 and became permanent in 1998. They are just another tool to help in retirement planning.

By 1955, Congress knew that Social Security was in financial trouble to accomplish that goal. So working with the IRS, they passed laws to help induce Americans to save for retirement and supplement what little they would get from Social Security. That is where IRA, Keogh, SEP, and 401k plans come from, which have a favorable impression in most Americans' minds.

Home Equity Conversion Mortgage (HECM) programs were another part of that ongoing federal social legislation. But the HECM program suffers from a mixed reputation. Why?

Some mortgage companies in the 1960s came up with an idea for a new type of loan they called a reverse mortgage.

Under their plan, you signed over the title to your home to the lender. The lender would allow you to live in your home for the rest of your life. While they would make your mortgage payments for you and pay you an income per month for your life. Then, when you and your spouse passed away, the lender owned the house. This program was a good solution for some people with not enough income to live on; however, there was a problem.

Starting in the mid-1970s, these reverse mortgage homeowners began to pass away, and that’s when many of their grown children found out for the first time that they weren’t going to inherit the home.

There were several newspaper articles about the turmoil. Mistreatment of seniors, or elder abuse, was the subject of many articles by columnists like Ann Landers. There were several lawsuits, investigations, congressional hearings, and lots of bad press. By the early 1980s, these so-called “reverse loans” had all but vanished.

However, an entire generation, the Baby Boomers and their children, now believed that anything called a reverse mortgage was terrible. But the only thing those programs from the 1960s have in common with the current programs, which didn't become permanent until 1998, is the same nickname, reverse mortgage. Otherwise, they have nothing in common with one another.

It is important to remember that HECM loans are a piece of federal social legislation like IRA, Keogh, and 401k plans that private companies administer. HECMS were signed into law in 1988 and became permanent in 1998. They are just another tool to help in retirement planning.

Retirement researchers make a new case for reverse mortgages.

Like many Americans, your house is your greatest asset. You’ve invested years building equity in your home. Now, it’s time to put that home equity to work for you. Learn about the tools available to help you tap into this valuable resource. Collaborate with trusted advisors to develop a solid financial plan that will enable you to retire with more. Retire better.

A growing number of retirement researchers, such as Harold Evensky, John Salter, and Wade Pfau, have carried out a significant amount of research to evaluate the benefits and drawbacks of a reverse mortgage. In addition to the potential uses for it and the value it adds to the retirement income distribution planning. All of these highly respected researchers have reached the same conclusion, which is that the reverse mortgage credit line provides particular value as a tool that can increase the likelihood of successful client outcomes and legacy value.

How can a reverse mortgage be a tool for retirement?

“A fiduciary planner has to look out for the best interests of their clients. As a side effect, the best interests of the planner can be served through research that shows how the legacy value of assets can be improved by a reverse mortgage.” —Wade D. Pfau, Ph.D., CFA, Professor of Retirement Income, The American College

According to Wade Pfac, leading expert in legacy wealth planning. As of September of 2018, The results of studies conducted over the past few years have, in general, indicated that this conventional wisdom is limiting and unproductive. Beginning the process of getting a reverse mortgage sooner and planning out your spending from the equity in your home over the course of your retirement will help you fulfill your spending goals while also leaving a larger legacy. Utilizing one's assets in a manner that paves the way for increased spending and/or increased legacy-leaving capacity is the essence of retirement-income efficiency.

The value of any remaining financial assets along with the value of any remaining home equity after the reverse mortgage loan balance has been repaid is what is referred to as legacy wealth. Since money can be exchanged for other forms, it is not particularly relevant important to know the exact ratio of financial assets to remaining home equity. Only the combined weight of these two aspects will be considered significant in the final analysis.

HECM Line of Credit: A unique safety net offering a growth feature and flexible repayment

With its flexible payment options, a HECM can give eligible clients more financial control and can help you design more solutions for your clients. It can serve as an excellent risk management tool that can help keep productive assets under your management and help their portfolios last longer.

Wade Pfau states, “The line of credit provides a way to create a more efficient retirement income strategy while also serving as a hedge if the client’s home value were to fall. It is essentially a put option on the value of the home.”

Right size into a home that is right for you.

You can also use a reverse mortgage to help you purchase a new home. With the HECM for Purchase option, you’ll need cash or equity from a prior home to put down a relatively large down payment, and you can use the reverse mortgage to finance the rest of the home purchase.

Jumbo Reverse Mortgages are available for High-Valued homes if you choose to Age in Place.

Some reverse mortgage lenders have developed their versions of the government-backed home equity conversion mortgage (HECM) product in response to the substantial increase in home property values in particular regions of the United States. This is their answer to the federally insured HECM reverse mortgage loan, which can only cover a certain amount of a home's value.

These programs have the same safety provisions as the FHA (federal housing administration) HECM program. Like the FHA loan, this loan is still non-recourse. The title stays in the homeowner’s name, the children still inherit, and so on with non recourse loans.

What is significantly different is that we can use full property values of up to $10 million to make a loan of up to $6 million. There are no monthly payment requirements for these jumbo reverse mortgage loans.

Repaying the Loan

Loan repayment is not due as long as you meet the loan obligations.

When it comes time to repay the loan, neither you nor your heirs will be obliged to pay more than the home's current market value. Even if the outstanding balance on your mortgage is more than the home's value, the loan will be paid off as long as you or your heirs decide to sell the home. Best of all, any remaining equity goes to you or your heirs once the loan is repaid.

For heirs wishing to keep the home, a larger legacy offers an extra bonus of additional financial assets after the loan balance has been repaid. The home is not lost.

A growing number of retirement researchers, such as Harold Evensky, John Salter, and Wade Pfau, have carried out a significant amount of research to evaluate the benefits and drawbacks of a reverse mortgage. In addition to the potential uses for it and the value it adds to the retirement income distribution planning. All of these highly respected researchers have reached the same conclusion, which is that the reverse mortgage credit line provides particular value as a tool that can increase the likelihood of successful client outcomes and legacy value.

How can a reverse mortgage be a tool for retirement?

“A fiduciary planner has to look out for the best interests of their clients. As a side effect, the best interests of the planner can be served through research that shows how the legacy value of assets can be improved by a reverse mortgage.” —Wade D. Pfau, Ph.D., CFA, Professor of Retirement Income, The American College

According to Wade Pfac, leading expert in legacy wealth planning. As of September of 2018, The results of studies conducted over the past few years have, in general, indicated that this conventional wisdom is limiting and unproductive. Beginning the process of getting a reverse mortgage sooner and planning out your spending from the equity in your home over the course of your retirement will help you fulfill your spending goals while also leaving a larger legacy. Utilizing one's assets in a manner that paves the way for increased spending and/or increased legacy-leaving capacity is the essence of retirement-income efficiency.

The value of any remaining financial assets along with the value of any remaining home equity after the reverse mortgage loan balance has been repaid is what is referred to as legacy wealth. Since money can be exchanged for other forms, it is not particularly relevant important to know the exact ratio of financial assets to remaining home equity. Only the combined weight of these two aspects will be considered significant in the final analysis.

HECM Line of Credit: A unique safety net offering a growth feature and flexible repayment

With its flexible payment options, a HECM can give eligible clients more financial control and can help you design more solutions for your clients. It can serve as an excellent risk management tool that can help keep productive assets under your management and help their portfolios last longer.

Wade Pfau states, “The line of credit provides a way to create a more efficient retirement income strategy while also serving as a hedge if the client’s home value were to fall. It is essentially a put option on the value of the home.”

Right size into a home that is right for you.

You can also use a reverse mortgage to help you purchase a new home. With the HECM for Purchase option, you’ll need cash or equity from a prior home to put down a relatively large down payment, and you can use the reverse mortgage to finance the rest of the home purchase.

Jumbo Reverse Mortgages are available for High-Valued homes if you choose to Age in Place.

Some reverse mortgage lenders have developed their versions of the government-backed home equity conversion mortgage (HECM) product in response to the substantial increase in home property values in particular regions of the United States. This is their answer to the federally insured HECM reverse mortgage loan, which can only cover a certain amount of a home's value.

These programs have the same safety provisions as the FHA (federal housing administration) HECM program. Like the FHA loan, this loan is still non-recourse. The title stays in the homeowner’s name, the children still inherit, and so on with non recourse loans.

What is significantly different is that we can use full property values of up to $10 million to make a loan of up to $6 million. There are no monthly payment requirements for these jumbo reverse mortgage loans.

Repaying the Loan

Loan repayment is not due as long as you meet the loan obligations.

- Living in the home as your primary residence,

- Continuing to pay required property taxes and insurance,

- Maintaining the home according to FHA requirements.

When it comes time to repay the loan, neither you nor your heirs will be obliged to pay more than the home's current market value. Even if the outstanding balance on your mortgage is more than the home's value, the loan will be paid off as long as you or your heirs decide to sell the home. Best of all, any remaining equity goes to you or your heirs once the loan is repaid.

For heirs wishing to keep the home, a larger legacy offers an extra bonus of additional financial assets after the loan balance has been repaid. The home is not lost.

Who Can Benefit From a Reverse Mortgage

The Safety Net SeekerSusan was a busy exec at a fortune 500 company. Divorced and in her early 60’s she was assessing her retirement plan with her advisor. She had done well and had plenty of funds set aside for retirement. Between her pension, self-directed 401K and social security, she looked forward to a comfortable retirement. However, her advisor Karen knew that the best laid plans can go astray.....Find out how Susan was able to have enough income through her retirement planning.

|

The MaximizerJeffrey wanted to make sure he would be able to maximize the income from his investment portfolio. He met with the wealth manager at his local bank and was concerned when they discussed what might happen if his stock-based portfolio should decline in a bear market.

Jake, his banker, put him in touch with me.....See how a reverse mortgage helped Jeffrey with his investment portfolio. |

The HomebodyGary and Jean had decided that they wanted to live in their current home for the rest of their lives. They had spoken to their grown sons and neither one wanted their parents’ home once they died. So, maximizing income while alive was the only consideration when they called me at their accountants advise. .....Learn how Gary and Jean were able to maximize their legacy wealth.

|

|

The Eager Retiree

Donald had been self-employed his entire life. A risk-taking serial entrepreneur, he had always believed in himself and invested all his money in his business ventures. Sometimes he was successful, sometimes not. One of his successful investments was buying his home. He had cash when the real estate market collapsed and bought the rather large house on ten acres at a great price. In the decade since the value of his home skyrocketed. Now, he was finally ready to retire from...Read on to find out how Donald used a Reverse Mortgage meet his goals

|

Is a Reverse Mortgage right for you?

Everyone's situation is different - take our Self-Evaluation and we will get in touch with you and let you know if a reverse mortgage can work for you and if so what it will accomplish. If not, we will be more than happy to point you in the right direction - free of charge. Together we can custom design a solution to your needs.

You Can Access Your Home's Equity

For many borrowers, this is the main reason a reverse mortgage is the right choice. Access to funds from one's home equity to pay bills and expenses during retirement or pay off other obligations can help immensely alleviate financial worry.

Reverse mortgages are a versatile financial tool that nearly a million homeowners have used to age in place and for other reasons. However, like any financial product, reverse mortgages should be considered carefully before deciding whether to obtain one. Take the NRMLA self-evaluation and have Mathius M. Gertz, the reverse mortgage expert, personally call you and answer your questions.

You Can Access Your Home's Equity

For many borrowers, this is the main reason a reverse mortgage is the right choice. Access to funds from one's home equity to pay bills and expenses during retirement or pay off other obligations can help immensely alleviate financial worry.

Reverse mortgages are a versatile financial tool that nearly a million homeowners have used to age in place and for other reasons. However, like any financial product, reverse mortgages should be considered carefully before deciding whether to obtain one. Take the NRMLA self-evaluation and have Mathius M. Gertz, the reverse mortgage expert, personally call you and answer your questions.

Let us separate fact from fiction and

Reverse Your Thinking® about Reverse Mortgages!

What Trusted Advisors Say About Marc

Hecker FiduciaryMarc Gertz is a wonderful collaborator. He has been a true professional partner through the process of getting liquidity out of my clients estates, so that I can help them live out their lives according to their wishes. He has helped me with difficult to resolve loan issues. He also is a great resource in finding other professionals that may be needed in the course of my work. I highly recommend that all fiduciaries consider consulting with him about anything to do with reverse mortgages. I trust him with my clients. You can too.

|

Select Fiduciary Group LLCMarc Gertz is a premier financial consultant for fiduciaries and their clients. He understands deeply the myriad ways reverse mortgages can be used to provide an income stream, a lump-sum payment or to match cash flow distributions to your clients unique financial, retirement, estate planning and business succession needs. He also understands how to use these products for asset protection. He is both a strategist who sees the big picture, and a tactician who can sift through the details to find the key information that matters. His skill as a story-teller helps you translate complex information into easy-to-understand ideas that your clients will understand. He will collaborate with you to decide whether a reverse mortgage is a right solution for your client. You will be well-served to get to know Marc before you need him.

|

Welcome Home | Apply Now | Self-Evaluation | What is a Reverse Mortgage? | Terms Of Use | Privacy Policy | ADA | Glossary

Knowledge Centre | Professional Concierge| Blog | Video | In the News | Registration

Knowledge Centre | Professional Concierge| Blog | Video | In the News | Registration

310-447-5266 | [email protected]

Mathius Marc Gertz MBA, AFC®, CDLP®, CREV, CAPS | DRE #01999021 | NMLS #1125159 | Team Reverse Your Thinking®

E Mortgage Capital, Inc. d/b/a E Mortgage Capital, NMLS# 1416824. Equal Housing Lender

Reverse Your Thinking ® | Copyright 2018-2024 | Sitemap | Website by Rhonda May

E Mortgage Capital, Inc. is a full-service mortgage company that offers extensive options for residential mortgages, with quick service and leading rates

DISCLAIMER: All rights reserved. For information purposes only. This is not an offer to enter into an agreement. This is not a commitment to lend or extend credit. NOT all customers will qualify.

Information, rates and programs are subject to change without notice. All products are subject to credit and property approval and lender underwriting.

Other restrictions and limitations may apply. For licensing information, go to: www.nmlsconsumeraccess.org

Designated trademarks and brands are the property of their respective owners. This site should not be considered an advertisement in the following states: AZ, CA, Fl, IA, MN, NJ, SC, WI.

No mortgage loan applications for properties located in these states will be accepted through this site.

SAYWHYNOT, Incorporated| DRE # 02139767 | NMLS # 2161957 | Mailing Address: 12400 Ventura Blvd Suite 222, Studio City, CA 91604

Mathius Marc Gertz MBA, AFC®, CDLP®, CREV, CAPS | DRE #01999021 | NMLS #1125159 | Team Reverse Your Thinking®

E Mortgage Capital, Inc. d/b/a E Mortgage Capital, NMLS# 1416824. Equal Housing Lender

Reverse Your Thinking ® | Copyright 2018-2024 | Sitemap | Website by Rhonda May

E Mortgage Capital, Inc. is a full-service mortgage company that offers extensive options for residential mortgages, with quick service and leading rates

DISCLAIMER: All rights reserved. For information purposes only. This is not an offer to enter into an agreement. This is not a commitment to lend or extend credit. NOT all customers will qualify.

Information, rates and programs are subject to change without notice. All products are subject to credit and property approval and lender underwriting.

Other restrictions and limitations may apply. For licensing information, go to: www.nmlsconsumeraccess.org

Designated trademarks and brands are the property of their respective owners. This site should not be considered an advertisement in the following states: AZ, CA, Fl, IA, MN, NJ, SC, WI.

No mortgage loan applications for properties located in these states will be accepted through this site.

SAYWHYNOT, Incorporated| DRE # 02139767 | NMLS # 2161957 | Mailing Address: 12400 Ventura Blvd Suite 222, Studio City, CA 91604