Reverse Your

Thinking®

About Reverse Mortgage

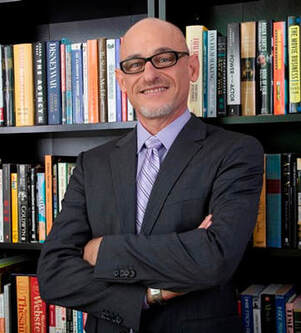

with Mathius M. Gertz

MBA, AFC®, CDLP®, CREV, CAPS

Reverse Your

|

|

Reverse Your

|

|

Real Solutions |

Real People |

Real Outcomes |

Mathius Marc Gertz MBA, AFC®, CAPS

Mathius Marc Gertz MBA, AFC®, CAPS

|

Fiction: With a reverse mortgage, you are selling your house to the bank, and the house has to be free and clear to qualify.

FACT: Homeowners never give up title or ownership of their homes, and most homeowners use loan proceeds to pay off an existing loan on their primary residence. Fiction: Reverse mortgages are costly and have high closing and origination fees.

FACT: Interest rates are comparable to conventional Federal Housing Administration (FHA) rates, and fees vary by lender. Sometimes there are virtually no closing costs, with one exception. There is an insurance fee that is unique to a HECM that guarantees that this is a non-recourse loan, when the loan must be repaid. There are different types of reverse mortgages. Ranging from traditional HECM loans to proprietary reverse mortgages like jumbo reverse. Our company works with twelve different reverse companies with fifteen different reverse style programs to design the best programs to solve your problems. Fiction: If the home loan balance grows bigger than the home value, the borrower is on the hook for the difference.

FACT: All reverse mortgages are non-recourse loans, and a borrower, the estate, the children, or the trust will never owe the lender more than the current value of the home. The current design of these loans is that there are substantial assets for inheritance from the family home after the homeowners die or if they decide to sell the home while still alive and downsize. Fiction: All reverse mortgage funds you receive need to be explained, justified, and approved for use by the lender, the Federal Housing Administration (FHA), and the Department of Housing and Urban Development (HUD).

FACT: There are no restrictions, approvals, explanations, or reporting required. Funds may be used for any purpose, at will, without justification from any government agency. Currently, all types of reverse loan proceeds are received tax-free and do not need to be claimed on your tax returns. After you receive your funds, you can consult with a trusted advisor and make any decisions you wish about how you spend, preserve or invest your loan proceeds. |

Fiction: I will lose my government assistance if I get a reverse mortgage.

FACT: A reverse mortgage does not affect regular Social Security or Medicare benefits. However, if you are on Medicaid or Supplemental Security Income (SSI), any reverse mortgage funds you receive must be used immediately. For example, everything is fine if you request $4,000 in a lump sum for home repairs and spend it all in the same calendar month. A HECM line of credit can be a good solution. Fiction: Reverse mortgages are a loan of last resort. They are only for people in desperate financial conditions.

FACT: Many people use a HECM Line of Credit as a safety net to draw on in an emergency. In addition, getting a Portfolio reverse mortgage of up to six million dollars is now possible. They use this money to invest, create retirement income, and use the HECM to pay for property taxes and homeowners insurance along with home repairs. Reverse loans are now used in sophisticated retirement planning and asset protection programs. They are a hedge against portfolio drops due to a Bear Stock Market, housing market crash or used to delay taking Social Security benefits till age 70. Even used for asset protection to help make your home impervious to slip-and-fall lawsuits. Call us to discuss the particulars of your situation. Fiction: There are few differences between a HECMLOC (Home Equity Conversion Mortgage Line Of Credit) and a HELOC (Home Equity Line of Credit).

FACT: They are entirely different except that they are both lines of credit that use your home as collateral for the loan. Most importantly, once in place, a reverse line of credit is no longer tied to the value of your home. Therefore the lender cannot call, cancel or reduce the line of credit, even if the value of your home decrease. Let us separate fact from fiction and Reverse Your Thinking® about reverse mortgages! |

|

Marc came to my rescue. He structured the Jumbo-Reverse loan so I was able to set aside $1,000,000 towards monthly income.

He made sure my appraisal came in at full value. Now I will be able to stay here for the rest of my life. He is the best at what he does. Call him! – David H, Beverly Hills, CA Marc did a great job getting me qualified so I could use a reverse mortgage-for- purchase to buy my retirement home. He overcame many financial obstacles on my behalf and succeeded where others would have failed. I’ve actually come to think of him as a loyal friend.

– Gloria L, Tucson, AZ |

Marc did a financial analysis for me and showed me how I was going to run out of money in 6 months. He was honest and he structured a reverse mortgage for me that not only cleaned up my bills, but also fixed up my house and gave me time to sell my business. Today I am debt free, my stress is down and my health and quality of life is better thanks to him.

– Paul Z, Lake Arrowhead, CA Marc got me a reverse mortgage on my mobile home. My taxes are paid, my bills are paid off, and I have a car that is reliable and money in the bank. He did a great job and he is a nice guy.

– Johnny P. Camarillo, CA |

|

|